From Drowning to Direction: How Financial Therapy Transforms Your Relationship with Money

Who is Financial Therapy For?

Financial therapy is for people who feel like they’re drowning in money stress—working hard, trying to do the “right” things, yet still feeling lost or off course. It’s especially for those who realize that more spreadsheets or self-discipline aren’t enough. Sometimes, the fastest way to financial safety means first turning toward what feels like the wrong direction—addressing your emotions, fears, and past experiences with money. Financial therapy helps you do that, so you can finally get to solid ground and start moving forward with clarity and confidence.

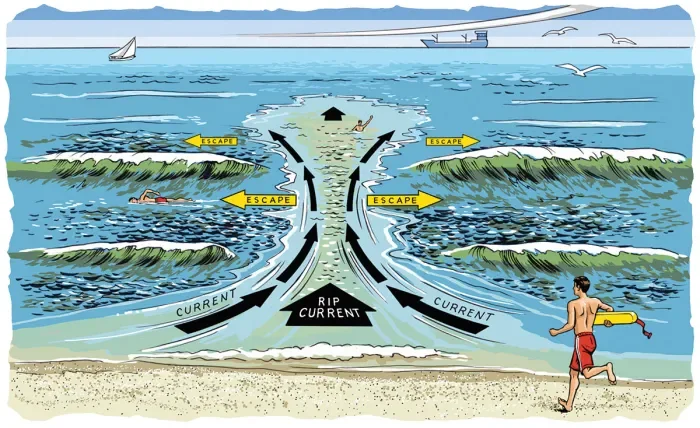

You’re in a Riptide

Why Logic Fails Your Finances

Recently, I was at a conference and asked a group of experienced financial coaches the same question I’m often asked myself: Why would someone pay for financial therapy or coaching when they’re stuck in so much debt?

I heard a lot of answers that made sense:

“They need help, because their decisions are more than math.”

“But they’re not getting out of debt on their own, and they’re spending that money on something. Better that they spend it on financial therapy. ”

But the practical side of me knew that the argument still remained: People have a hard time justifying that the money that should be going to debt go to a therapist or coach instead.

Until I realized a paradigm-shifting analogy: The Riptide.

Every summer we go to the New Jersey Shore, and we hear the same caution: Do not swim outside the Yellow Flags.

There are rip currents—deep, powerful, narrow channels that push you rapidly out to sea. They form when waves push water onto the beach, and that water finds a concentrated path back out. The result is a strong, swift current that pulls you into deeper water, often causing panic and exhaustion.

The conference director always reminds us that if we swim against the current, we’ll flounder and drown. It’s impossible to make it to shore when the water is so much more powerful than you.

So what’s the answer?

The answer is to do what isn’t logical. It’s to swim parallel to shore, way out in the middle of the ocean. And often you have to swim parallel for longer than you think necessary—then you turn and make progress toward land.

How Is Your Financial Situation Like a Rip Current?

Compounding interest and debt is a powerful and swift current designed to make you drown.

The reality is: the behavior that got you into debt is still there — you have to change direction. And often you have to go “the wrong direction” (i.e., pay for help) before you’re able to capitalize on behavior change and move toward your financial shore.

The Missing Link: Behavior, Values, and Stress

Financial problems are rarely just about money; they’re about behavior, values, stress, and relationships.

You write down a perfect budget on immovable paper, but if you don't address the behavior pulling you away into debt, you'll constantly struggle to make it work.

Financial Therapy is the specific, qualified discipline that addresses the intersection of finance and mental wellness—helping you escape the current and achieve lasting change.

What Exactly Is Financial Therapy?

The Integrated Approach

Financial Therapy is an emerging, specialized field that sits at the intersection of mental health and finance.

It is distinct because it doesn’t just offer financial advice—it actively addresses the emotional, cognitive, behavioral, and relational components of your financial health.

A Financial Analyst gives you investing advice, but ignores emotion, relationships, or behavior.

A Traditional Therapist helps with emotions and diagnoses, but avoids practical financial steps.

A Financial Coach focuses on action, but is unequipped to dive into relational and historical emotions, including divorce, trauma, or loss.

The core difference: Traditional Finance or Coaching focuses on future actions.

Financial Therapy addresses past history, relationship dynamics, family lessons, and present behavior.

How Expertise Is Combined

Financial therapy is an interdisciplinary approach. Professionals in this field have training in both mental health (therapy/counseling) and financial coaching.

This dual expertise ensures that your emotional well-being and practical financial needs are addressed simultaneously—in a structured, professional, and therapeutic environment, not through general “money talk.”

The Key Components

Exploration of Money History: Looking at family history, early experiences, and inherited beliefs about wealth or poverty.

Identification of Money Scripts: Unconscious, often negative beliefs that drive behavior (e.g., “I don’t deserve money,” “Money is always scarce,” “If I have money, I have to give it or spend it—it will be gone tomorrow”).

Healing Financial Trauma: Addressing shame, anxiety, or relationship conflict tied to money.

The Dual Benefits (Emotional & Practical)

Emotional and Mental Health Benefits (Rewriting Your Financial Narrative)

Reduced Financial Anxiety & Stress: Moving from dread to peace. This is the number one benefit—and often the quickest win my clients experience.

Overcoming Financial Shame or Guilt: Separating self-worth from net worth.

Improved Communication: Learning to talk about money with a spouse or family without fighting.

Increased Self-Awareness: Understanding why you spend, save, or avoid—and making proactive decisions to pursue your financial and life goals.

Rewriting your Money Story means shifting from passively watching the story to becoming the author and director—designing a story you’re in control of and proud of.

A financial therapist empowers you to move from mindless reaction to conscious direction—going from drifting in an ocean (or drowning in a rip tide) to knowing how to save yourself from the current.

Practical and Tangible Benefits (The Results)

Sustainable Habit Change: Not just setting a budget, but sticking to it because the root cause of spending is addressed.

Improved Confidence in Savings & Goal Attainment: Making decisions from clarity, not fear.

Better Decision Making: Reducing impulsive purchases and self-defeating financial patterns.

Who Needs Financial Therapy?

The Chronic Self-Saboteur

People who earn good money but can’t save. They’re stuck in a cycle of debt, denial, or shame. They “know” what to do—but don’t, for unexamined reasons.

Couples in Conflict

Money fights are relationship fights. One spouse saves, the other spends. One hides money, the other controls it. How we use money often mirrors our love languages.

Those with Financial Avoidance

People who never check accounts, ignore bills, or feel anxiety opening financial mail. Credit cards make it easy to skate along—until the limit hits, and they feel like they’re drowning.

Those Managing Major Life Transitions

Inheritance, divorce, job change, or sudden loss of income—all times when high emotion meets high stakes. Stress adds brain fog, distraction, irritability, or panic.

While we often address money matters in the context of couples or family dynamics, financial therapy is key for individuals navigating solo financial independence. If you are learning to manage money, major decisions, and long-term security on your own, explore our dedicated guide: Money Therapy On Your Own: Finding Clarity and Peace Without a Spouse

Examples of Success in Action

The following stories are based on common client patterns and show the real wins experienced by those who take part in Financial Therapy:

1. The Fear of the Next Big Expense

This individual struggled with passive money management and financial avoidance, constantly fearing being blindsided by unexpected costs, particularly large medical expenses. Despite not having high debt, they relied on short-term fixes and temporary outside support because they couldn't establish proactive saving habits. Financial therapy helped them dismantle the anxiety fueling the avoidance and establish a forward-looking financial routine. Outcome: Within three months, they created a vibrant, working budget, successfully saved for the following month's rent, and gained the mental bandwidth and clarity to actively pursue entrepreneurial goals.

2. Trading Convenience for Control

This busy individual, dedicated to childcare and managing a household, struggled with decision fatigue and distraction, which led to high-cost convenience spending (like frequent food delivery). This resulted in stress and a lack of preparation for large, recurring costs like seasonal utility bills. Therapy focused on linking the spending to emotional triggers and implementing behavioral changes and mindset shifts. Outcome: The client established a stable, proactive cash flow—utilities and mortgage saved for the next month—and successfully pre-saved a significant portion of their large seasonal expenses, replacing guilt with confidence.

3. The Debt Fueled by Competitive Spending

This high-earning couple was near divorce due to chronic financial conflict and over $100k in variable debt. The conflict was driven by a pattern of retaliatory spending where one partner's anxiety-driven austerity was met with the other's control-driven splurges. Therapy addressed the relationship's core dynamic, establishing an environment of trust and non-judgment for discussing fear and differing money scripts. Outcome: The couple ceased competitive spending and replaced it with unified, values-driven goal setting. They established healthy financial communication, created a collaborative debt reduction plan, and reported a profound increase in relationship intimacy and security.

Conclusion & Next Steps

Financial stability requires both a clear, flexible, and do-able financial plan (often used in Traditional Finance), as well as a healthy relationship with money (Behavioral Finance & Financial Therapy).

Financial therapy isn't just a band-aid; it's a deep, foundational change that impacts all areas of life. Clients don’t only know where their money is going, how they’re using it, or how much they need; They also find peace and the ability to breathe—allowing them to move into greater areas of productivity and often achieve professional clarity and drive.

If you’re curious how these ideas can help with your money story, let’s talk. Book a free intro call here and stop drowning - instead start moving with direction.

This post may contain affiliate links. That means if you purchase something through these links, I may earn a small commission—at no cost to you. I only recommend things I use, respect, or love.